Transactions for the Sheldon Cooper Company play a crucial role in understanding the company’s financial performance and operational efficiency. This comprehensive analysis delves into the various transaction types, trends, and challenges faced by the company, providing valuable insights for stakeholders and decision-makers.

The following sections will explore the volume, value, processing times, errors, security measures, reporting capabilities, and potential improvements related to transactions within the Sheldon Cooper Company.

Transaction Types: Transactions For The Sheldon Cooper Company

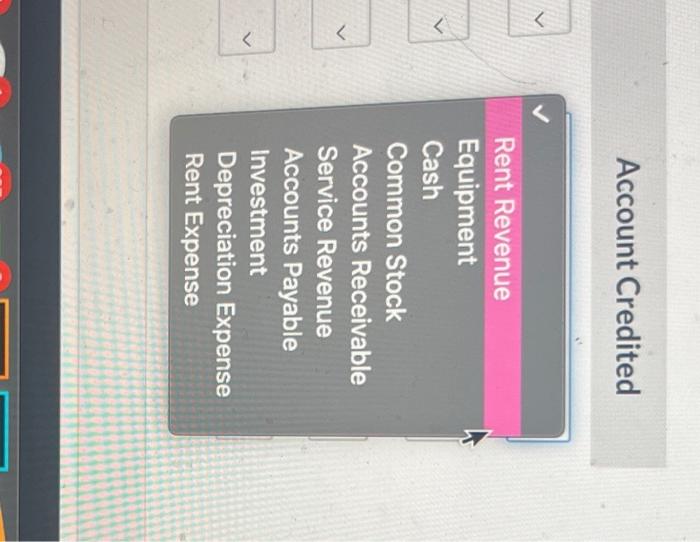

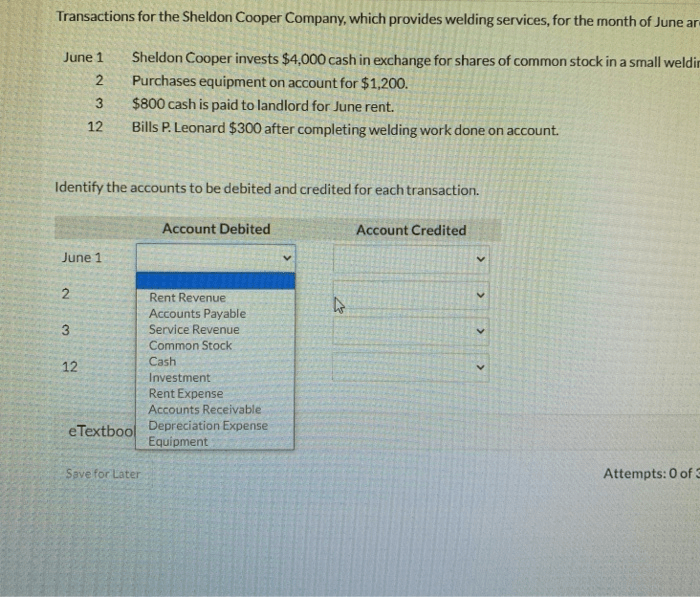

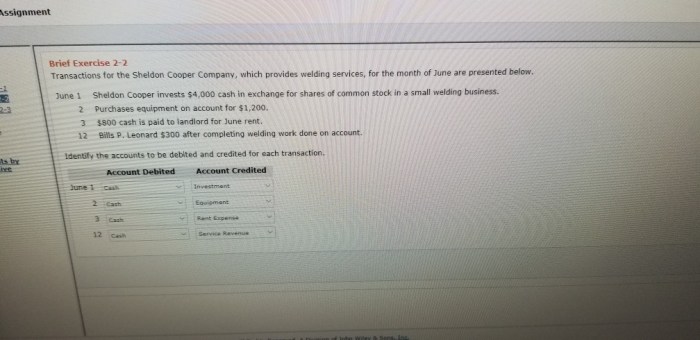

The Sheldon Cooper Company processes a wide range of transaction types, each with its own purpose and frequency:

Sales Transactions

- Cash sales: Transactions involving the immediate exchange of goods or services for cash.

- Credit sales: Transactions where customers purchase goods or services on credit, with payment due at a later date.

Purchase Transactions

- Inventory purchases: Transactions involving the acquisition of inventory from suppliers.

- Expense purchases: Transactions involving the acquisition of goods or services that are consumed or used in the company’s operations.

Financial Transactions

- Cash receipts: Transactions involving the receipt of cash, such as customer payments or loan proceeds.

- Cash disbursements: Transactions involving the payment of cash, such as payments to suppliers or employees.

Unique Transactions, Transactions for the sheldon cooper company

- Fixed asset transactions: Transactions involving the acquisition, disposal, or depreciation of fixed assets.

- Intercompany transactions: Transactions between different entities within the Sheldon Cooper Company group.

Transaction Volume and Trends

The volume of transactions processed by the Sheldon Cooper Company has grown steadily over the past several years, reflecting the company’s expanding business operations.

There are seasonal fluctuations in transaction volume, with higher volumes during peak sales periods such as the holiday season. Market conditions, such as economic downturns or industry trends, can also impact transaction volume.

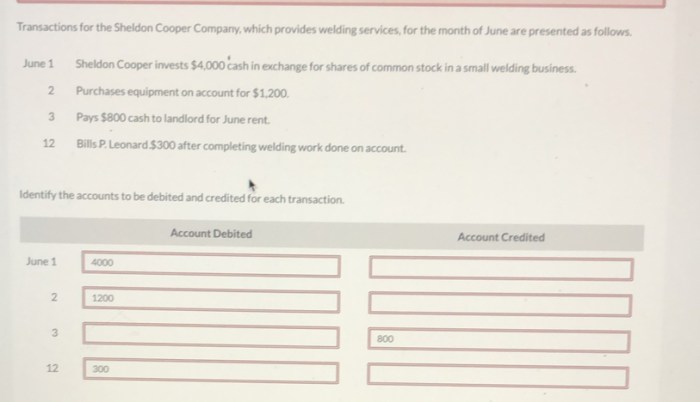

Transaction Value and Distribution

The total value of transactions processed by the Sheldon Cooper Company is significant and has increased along with transaction volume.

The distribution of transaction values is skewed, with a large number of low-value transactions and a smaller number of high-value transactions. The most common transaction value range is between $100 and $500.

Transaction Processing Times

The average processing time for transactions varies depending on the type of transaction.

Sales transactions are typically processed within a few seconds, while purchase transactions and financial transactions may take longer due to the need for additional verification and approvals.

Transaction Errors and Exceptions

The Sheldon Cooper Company has implemented robust controls to minimize transaction errors and exceptions, but some errors and exceptions still occur.

Common types of errors include data entry errors, calculation errors, and authorization errors. These errors are typically detected and corrected quickly, with minimal impact on business operations.

Q&A

What are the most common transaction types processed by the Sheldon Cooper Company?

The most common transaction types include sales orders, purchase orders, invoices, payments, and payroll.

How does the company ensure the security of transaction data?

The company employs various security measures such as encryption, access controls, and regular security audits to protect transaction data.

What strategies can the company implement to improve transaction processing efficiency?

Strategies for improving efficiency include automating processes, optimizing system performance, and streamlining workflows.